It is important to understand that becoming a high net worth individual is a process that calls for commitment. Some of the challenges that many experience include poor financial literacy, limited investment options, and no well-defined strategy.

There are many models of High- Net-Worth Individual creation. It is a result of proper planning and consistent realization of the set goals. Education on money matters, identification of goals, and use of the right practices are the previous stages.

This guide offers a step-by-step strategy that will help you enhance your opportunity to become financially secure and classified as a member of the HNW segment.

Understanding High Net Worth Individuals (HNWIs)

High net worth individuals (HNWI) possess valuable financial resources. They are usually always able to maintain cash, and cash equivalent of at least $1 million. UHNWIs have more than $30 million and are moving up from there.

HNWI and UHNWI investors can invest in various securities such as shares, properties, and private equity. Knowledge of these definitions assists in identifying the various stages of wealth and the approaches necessary to achieve them.

Characteristics of HNWIs

Prosperous possesses certain psychological and behavioral characteristics. These people maintain a Patriarchal lifestyle and are hardworking while saving and investing money. They are also always updating themselves on investment and financial trends.

One of the main features is identifying the growth mentality that defines their wealth creation. Where many people observe threats, they discern possibilities. This mindset is very helpful in eradicating financial crises and creating wealth in the long run.

How to Build Wealth?

Here are some key insights about building wealth:

Education and Financial Literacy

The importance of financial education cannot be overstated especially in wealth matters. The knowledge about wealth helps a person make the right choices. It also enables you to stay abreast with financial trends and strategies.

You can also read books, online courses, and blogs on financial news websites to increase your level of financial literacy. Make it a habit to review what you’ve learned so you can make the best choices for your financial well-being.

Setting Clear Financial Goals

The steps to take to save a large amount of money include establishing financial objectives. Begin with small aims, for example, beginning to save money for emergency funds. Then, the working person is likely to consider long-term objectives, such as setting up for retirement. Setting goals is good, but the goals should be translated into manageable sub-targets you can attain. It also assists you in maintaining long-term goal direction, which often translates to long-term motivation.

Budgeting and Saving

Budgeting is one of the most basic steps toward building wealth. Prepare a budget that analyses your income and expenditure plan. Organize your expenditures so that you save and invest some of your money. Saving money regularly increases your net worth over time.

It is important to observe the culture of frequently saving part of one’s income. This creates a financial reserve and opens new opportunities for investments. Savings and budgeting are the most basic concepts of managing personal finance.

Investment Strategies for HNWIs

Here are some strategies to keep in mind before investment:

Understanding Different Asset Classes

Equities, fixed-income securities, real estate, and metals are examples of asset classes. All of them are different in terms of risk and return potential. Investing across different securities classes help to manage risk.

This means you should avoid concentrating your funds in any investment category. Diversification is another way of reducing risk and increasing the probability of making constant profits. It is an essential factor well understood in effective wealth management plans.

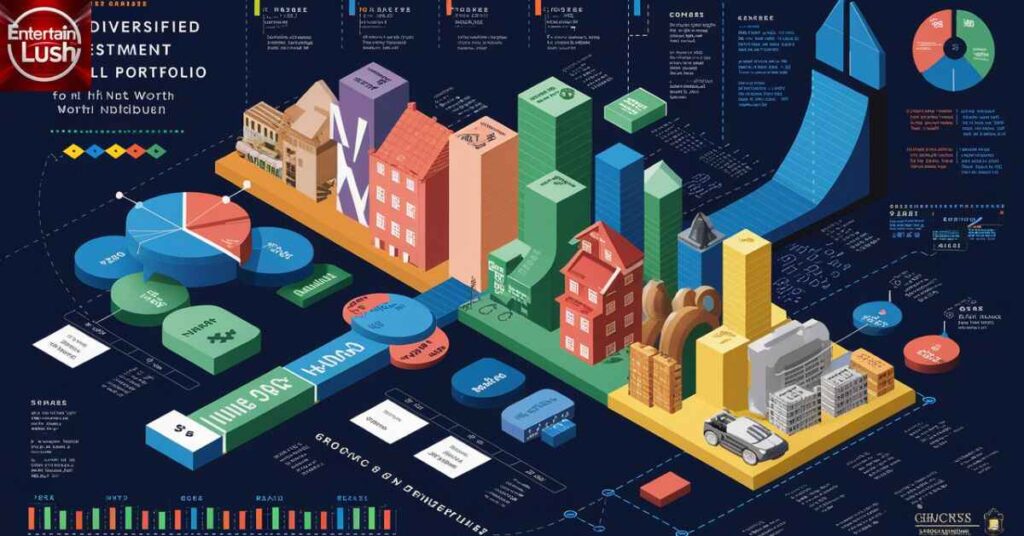

Building a Diversified Investment Portfolio

Diversifying investment means creating a well-balanced portfolio of different stock classes. Invest in stocks as a growth asset and bonds for stable returns. Real estate and other assets give further diversification. Risk management is crucial.

Do not put all your eggs in one basket; that is, do not risk all your money on high-danger choices. Revisiting your portfolio periodically and making necessary changes depending on your financial plans is also essential.

Utilizing Alternative Investments

Other types of investments include private equity, hedge funds, and commodities. They have high return results but are also associated with high risks. These are usually less liquid and more on the structure side.

However, they can differentiate portfolios and present remarkable opportunities. Therefore, it is important to consider all the pros and cons seriously when making a decision.

Growing Your Income

To smoothly grow your income, use the following strategies:

Increasing Your Earning Potential

Boosting income starts with career advancement. Seek promotions and higher-paying roles. Develop new skills through training and education. Networking and building relationships with industry professionals is crucial. Improving your skills and expanding your network significantly increases your earning potential.

Starting a Side Business

Starting a side business can significantly enhance wealth-building. Entrepreneurship provides additional income streams and financial security. Begin by identifying a market need you can fulfill.

Develop a business plan and take small steps to launch it. Use your skills and resources wisely. A successful side business can complement your primary income and accelerate your journey to becoming a high-net-worth individual.

Passive Income Streams

It is categorized as revenue that is generated without frequent engagements. Some examples are rental housing, stocks that provide regular dividends, and copyrights on products.

Investment always provides income, and wealth creation only requires direct effort in some of these methods. Constructing several types of passive income is a sound approach to earning stability. Wealth accumulation is a central pillar of long-term financial management.

Wealth Preservation Strategies

Following wealth preservation strategies help you to maintain and grow your wealth effectively:

Estate Planning and Wealth Transfer

Estate planning is an essential practice for high-net-worth individuals. It helps ensure that wealth is distributed according to one’s wishes as per the wills. Become a high-net-worth individual involves strategic financial planning and management.

Proper estate planning can also help in reduce taxation and legal complications for the beneficiaries. It also provides protection for your wealth and your family. Estate planning is a critical aspect of wealth and asset management, ensuring that all property owned is preserved.

Tax Optimization Strategies

Tax optimization also assists in improving wealth retention. These include optimizing deductions, utilizing tax-sheltered accounts, and donating to charities. Seeking the services of financial consultants is essential. They can also help you plan for your taxes to minimize.

Effective tax planning promotes wealth accumulation by allowing you to preserve your income as much as possible. It is important to review and update the tax plan to ensure compliance with new laws or changes in circumstances.

Insurance and Risk Management

If people want to preserve their wealth, they need to insure it. Insurance provides coverage on potential losses from events that may occur that are beyond an organization’s forecasts. High net worth individuals Insurance provides coverage on potential losses from events that may occur beyond an organization’s forecasts. look at insurance products like life and health insurance and property and liability insurance.

When a person can predict the occurrence of anything that may cause harm, they can figure out a way to avoid such events. Even if those events happen, they will have effectively managed risk.

The Mindset of Wealth Accumulation

Developing a Wealth Mindset

It is very important to embrace change, particularly in wealth creation exercise. It means assuming that you can increase your monetary literacy level. To develop this mindset, you should establish a target and feel encouraged.

Keep on learning more about managing money and investments. Surround yourself with positive influences and successful individuals. A wealth-focused mindset drives you to seek opportunities, overcome setbacks, and achieve financial success.

Overcoming Financial Obstacles

Financial difficulties always accompany the struggle for wealth. These consist of loans, emergencies, and volatility in the market. It’s better to discuss them and stay persistent and flexible. Use the financial roadmap to manage debts and accumulate funds for emergencies.

It is relevant to monitor changes in the economic environment and revise plans accordingly. Perseverance and flexibility are the keys to overcoming financial challenges and pressing forward towards the amassment of wealth.

Networking and Building Relationships

The Role of Networking in Wealth Building

Networking is one of the most favored strategies among HNWIs. It frees a person to new possibilities and perceptions. Fundamental business networking can result in successful partnerships and investments that benefit all parties.

Participation in professional associations and use of social media platforms. Networking enables people to gain knowledge from different team members, trends, and influence opportunities . Therefore, a good relationship is the foundation of wealth creation.

Learning from Other HNWIs

In particular, the opportunities given to young people in mentorship and peer interaction are impressive. There are two primary benefits of getting a mentor: they offer advice and information you can learn immediately or save you from making wrong decisions.

Friends and peers provide encouragement and an outsider’s view. When searching for potential mentors, the best place to look is your field or among your colleagues. Participate in events and send out requests for people to introduce themselves. Establishing these relationships improves your financial experience, offering the direction and support to attain wealth.

Frequently Asked Questions

What defines a high-net-worth individual?

A high-net-worth individual has at least $1 million in liquid assets. This excludes property and other non-liquid investments.

How can I increase my net worth quickly?

Focus on increasing your income and investing wisely. Diversify your investments and reduce unnecessary expenses.

What are the best investment strategies for HNWIs?

High-net-worth individuals (HNWIs) can benefit more from diversifying across asset classes and focusing on long-term growth in terms of investment strategies. Moreover, alternative investments can be used, and expert guidance can be sought for increased returns combined with efficient risk management.

Is entrepreneurship necessary to become a high-net-worth individual?

To become a high-net-worth individual you don’t have to be an entrepreneur, but it might help with the wealth creation process. Investment and high salary are common sources of wealth for HNWIs but business also offers another source of income and business opportunities.

How important is financial education in building wealth?

Financial education is one of the most excellent teachings that can assist people in accumulating wealth. It allows you to take proper initiatives to manage your money and lead a competent life.

Conclusion

Achieving high net worth requires planning and commitment over time as well as desire to save and invest properly. Concentrate on financial literacy, establish goals, and develop sound practices for investments.

Organize your finances and diversify your income and assets effectively to maximize your financial security. Develop positive attitudes toward growth and embrace affiliations.

Moreover, self-improvement, and accepting challenges are crucial. So, if you wish to attain a high net worth, you must dedicate yourself to the appropriate strategies.

Welcome to Entertainlush.com! Dive into a world of business insights, travel adventures, entertainment buzz, celebrity gossip, and sports highlights. Our expert writers bring you fresh, exciting content daily. Stay informed and entertained with Entertainlush.com!