Have you ever scrutinized your credit card statement and stumbled upon a charge from “BBCW Merchant“? This unfamiliar name can trigger alarm bells, especially if you don’t recall making such a purchase. The uncertainty of an unknown charge can lead to stress and worry about potential fraud. However, understanding what BBCW Merchant represents in your statement can alleviate these concerns.

This article will demystify BBCW Merchant charges, explain their legitimate sources, and provide guidance on what to do if you encounter one. By the end, you’ll know how to interpret this entry confidently on your credit card statement and take appropriate action if needed.

Understanding Credit Card Statements

Credit card statements show your monthly activity. They list purchases, payments, and fees. The billing cycle is the period covered. Transaction history details each charge. Review your statement regularly to spot errors or fraud. Understanding these basics helps you manage your finances better.

Decoding Merchant Names on Statements

Merchant names on statements can be confusing. They may differ from store names you know. This happens due to payment processors and merchant codes. Some businesses use parent company names. Others use abbreviations. Learning to decode these names helps you track your spending accurately.

Standard Confusing Charges and What They Mean

Many people find certain charges puzzling. Some common ones include annual fees, foreign transaction fees, and balance transfer charges. Cash advances often look different too. Knowing what these charges mean helps you avoid surprises. It also allows you to dispute any incorrect fees quickly.

Products and Services Offered by BBCW

| Category | Examples |

| Toys | Action figures, dolls, building blocks |

| Collectibles | Limited edition items, memorabilia |

| Board Games | Strategy games, family games, puzzles |

| Electronics | Educational toys, interactive games |

Why BBCW Merchant Appears on Your Statement

- You bought from a store that gets supplies from BBCW

- You purchased directly from BBCW’s online store

- You bought toys or collectibles from a third-party online marketplace

- BBCW supplied items for a subscription box you receive

- You purchased at a hobby shop that sources from BBCW

- You bought items at a toy convention where BBCW was a supplier

- BBCW processed a special order for a rare collectible

- You participated in a pre-order for upcoming toy releases

- BBCW supplied items for a school or organization bulk order

- You purchased gift cards from a retailer supplied by BBCW

Direct Purchases from BBCW

When you buy directly from BBCW, the charge is clear. It will show as “BBCW Merchant” on your statement. This happens if you use their online store or wholesale service. The amount will match your purchase exactly. Direct purchases are easy to track and verify.

Purchases from Retailers Supplied by BBCW

Sometimes, BBCW appears on your statement even when you shop elsewhere. This happens because many stores get their stock from BBCW. Toy stores, hobby shops, and gift shops often use BBCW as a supplier. So, your purchase from these shops might show BBCW as the merchant.

Online Marketplace Transactions

BBCW products often appear on popular online marketplaces. You might find their items on Amazon, eBay, or Walmart.com. These platforms allow third-party sellers to offer BBCW products. When you buy from these sellers, your statement might show BBCW as the merchant. This is because BBCW handles the shipping and processing for some marketplace transactions.

Identifying Legitimate BBCW Merchant Charges

To check if a BBCW charge is valid, review your recent purchases. Look for toy or collectible buys that match the charge amount. Check your email for order confirmations. If you shop online, check your account history on those sites. Most legitimate BBCW charges will connect to a recent purchase you made.

Typical BBCW Charge Amounts and Frequencies

BBCW charges vary widely. They range from a few dollars for small items to hundreds for collectibles. Most people see BBCW charges occasionally, not regularly. Frequent collectors might have more charges. The amount usually matches the price of toys or collectibles. Large or very frequent charges might need a closer look.

How BBCW Charges Appear on Different Banks’ Statements

| Bank | Card Description |

| NEW YORK, NY POS | BBCW DISTRIBUTORS 1234****6789 |

| LOS ANGELES, CA ECOM | BBCW DISTRIBUTORS 5678****1234 |

| CHICAGO, IL WEB | BBCW DISTRIBUTORS 9876****5432 |

| PHILADELPHIA, PA POS | BBCW DISTRIBUTORS 3456****7890 |

| SAN ANTONIO, TX ONLINE | BBCW DISTRIBUTORS 2345****6789 |

| SAN JOSE, CA ONLINE | BBCW DISTRIBUTORS 5432****9876 |

| AUSTIN, TX ECOM | BBCW DISTRIBUTORS 6789****1234 |

| SEATTLE, WA ECOM | BBCW DISTRIBUTORS 6789****1234 |

| DENVER, CO ONLINE | BBCW DISTRIBUTORS 4321****8765 |

| EL PASO, TX POS | BBCW DISTRIBUTORS 2345****6789 |

| HOUSTON, TX ONLINE | BBCW DISTRIBUTORS 4321****8765 |

| PHOENIX, AZ ECOMM | BBCW DISTRIBUTORS 6789****1234 |

What to Do If You Don’t Recognize a BBCW Charge

If you see an unfamiliar BBCW charge, don’t panic. First, check your purchase history and emails. Ask family members if they made the purchase. If you still can’t identify it, contact your bank. They can provide more details about the transaction and, if needed, guide you through the dispute process. Always report suspected fraud promptly.

Contacting Your Bank or Credit Card Issuer

Call your bank’s customer service when you need to question a BBCW charge. The number is usually on the back of your card. Tell them you want to inquire about a specific charge. They might transfer you to the fraud department. Be ready with your account details and the date of the charge. The bank can often provide more information about the transaction.

Disputing a BBCW Merchant Charge

To dispute a charge, start by calling your bank. Explain why you think the charge is wrong. They’ll guide you through their dispute process. You may need to fill out a form. Provide any proof you have, like receipts or emails. The bank will investigate and may temporarily credit your account. This process can take a few weeks. Stay in touch with your bank for updates.

Read This Blog: $2600 Stimulus Check for Seniors 2024: Everything You Need to Know

Protecting Yourself from Unauthorized BBCW Charges

- Use strong, unique passwords for online accounts

- Enable two-factor authentication when available

- Don’t share your credit card details over unsecured networks

- Keep your card in sight when making in-store purchases

- Regularly check your account activity online

- Be cautious when shopping on unfamiliar websites

- Consider using virtual card numbers for online shopping

- Keep your contact information up to date with your bank

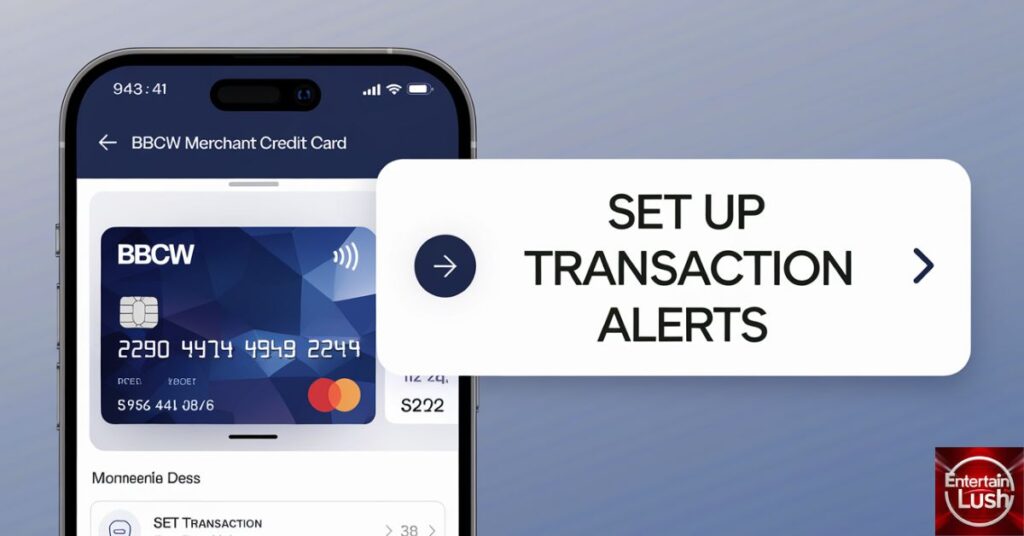

Setting Up Transaction Alerts

Most banks offer transaction alerts. You can set these up through your online banking or mobile app. Choose to get alerts for all purchases or just those over a certain amount. You can receive notifications by text, email, or push alerts. This helps you spot unauthorized charges quickly. It’s an easy way to keep track of your spending too.

Regularly Reviewing Your Credit Card Statements

Check your credit card statement at least once a month. Look at each transaction. Make sure you recognize all charges. This habit helps catch errors or fraud early. It also helps you understand your spending patterns. Set a reminder to review your statement when it’s available. If you spot anything odd, contact your bank right away.

BBCW Merchant’s Customer Service and Support

BBCW offers customer support for charge inquiries. You can reach them by phone or email. Their contact information is on their website. When you call, have your order details ready. They can help explain charges and resolve issues. BBCW’s support team can also assist with order tracking and product information.

Also Read: Emmy Rossum Net Worth

Resolving Issues Directly with BBCW

If you have a problem with a BBCW purchase, contact them first. Explain your issue clearly. They may offer a refund or exchange. For order issues, provide your order number. Be polite but firm about what you need. Keep records of all communications. If the issue isn’t resolved, you can then involve your bank.

Impact of BBCW Charges on Your Credit Score

BBCW charges themselves don’t directly affect your credit score. However, how you handle these charges can. Paying your credit card bill on time is crucial. High balances from BBCW purchases can increase your credit utilization. This might lower your score. Disputing legitimate charges can also have negative effects. Always pay your bills and use credit responsibly.

BBCW Merchant in the Larger Retail Ecosystem

BBCW plays a significant role in the toy and collectibles industry. They distribute to many retailers, big and small. This gives them a wide market reach. BBCW competes with other major distributors in the field. They follow industry trends, often stocking popular and emerging toy lines. Their presence affects pricing and availability in the retail market.

FAQ

What does BBCW stand for?

BBCW stands for Big Bad Toy Store, Wholesale. It’s a major distributor of toys and collectibles to retailers.

Is BBCW Merchant the same as Bed Bath & Beyond?

No, BBCW Merchant is not related to Bed Bath & Beyond. They are separate companies in different industries.

Can I buy directly from BBCW Merchant as a consumer?

Generally, no. BBCW primarily sells to retailers, and consumers usually buy from stores that stock BBCW products.

How long do I have to dispute a BBCW Merchant charge?

You typically have 60 days from the statement date to dispute a charge. Check with your bank for their specific policy.

Are BBCW Merchant always charged for physical products?

Not always. While most charges are for physical items, some might be for digital products or services related to toys and collectibles.

Conclusion

Understanding your credit card statement’s “BBCW Merchant” charge can save you from unnecessary stress. By knowing what represents a purchase of toys or collectibles—you can confidently verify legitimate transactions and take the appropriate steps if you suspect an issue. Regularly reviewing your credit card statements and staying informed about potential charges ensures better financial control and peace of mind.

Mr. Dravid is the dedicated author of the business category on Entertainlush.com. With a keen eye for industry trends and a passion for insightful analysis, he delivers valuable content that empowers readers to stay ahead in the ever-evolving business landscape. His expertise ensures that every article is both informative and engaging, helping audiences navigate the complexities of the business world.