An investigation into the country’s wealthy citizens shows how many Ultra High Net Worth Individual (UHNWIs) reside in America. It additionally informs readers that almost 99% of the populace own less than all combined do, while only 10% of people possess a great deal of money, indicating an unequal distribution of wealth within the US.

These are commonly known as ultra-high-net-worth individuals (UHNWI). How many are they out of the entire American population? This article moves more in-depth on wealth that is beyond normal limits.

Who Are Ultra High Net Worth Individuals?

UHNWIs refer to people whose net value is at least $30 million, composed of belongings, investments, plus cash, but minus all bills. This category is a notch higher than the HNWIs, who often possess assets ranging between $1 million and $30 million per individual.

The United States tops the list of nations with the highest number of UHNWIs worldwide. Consequently, more super-rich individuals reside within borders than in any other country. Certain aspects, such as the economy, politics, and social environment, shape this information.

Current Number of Ultra High Net Worth Individuals in the USA

By the year 2024, about 140,000 Ultra High Net Worth Individuals are currently living in the US, reflecting a steady increase within the last ten years, whereas there were around 69,560 UHNWIs as of 2014. Many things have contributed to this growth:

- A booming stock market

- Thriving tech sector

- Real estate appreciation

- Favorable tax policies

Geographical Distribution of US Ultra High Net Worth Individuals

UHNWIs are unevenly spread across the US. They tend to cluster in certain areas. Here’s a breakdown:

Top states with highest UHNWI concentrations:

- California

- New York

- Florida

- Texas

- Illinois

Major cities hosting the most UHNWIs:

- New York City

- Los Angeles

- San Francisco

- Chicago

- Miami

Urban areas attract more UHNWIs than rural regions. Among the reasons some ultra-wealthy people might opt for rural estates are privacy and lifestyle issues, although cities provide more business opportunities, luxury amenities, and networking potential.

Read This Blog: The Complete Guide to Laila Pruitt: Age, Bio, Height, Weight, and Net Worth (2024)

Demographics of Ultra High Net Worth Individuals in the US

Understanding which people form the UHNWI population gives helpful information on how wealth is spread.

Age breakdown:

- 50-70 years old: 65%

- 30-50 years old: 25%

- Over 70 years old: 8%

- Under 30 years old: 2%

Gender distribution:

- Male: 88%

- Female: 12%

The gender gap among UHNWIs is significant. It reflects broader issues of gender inequality in wealth accumulation.

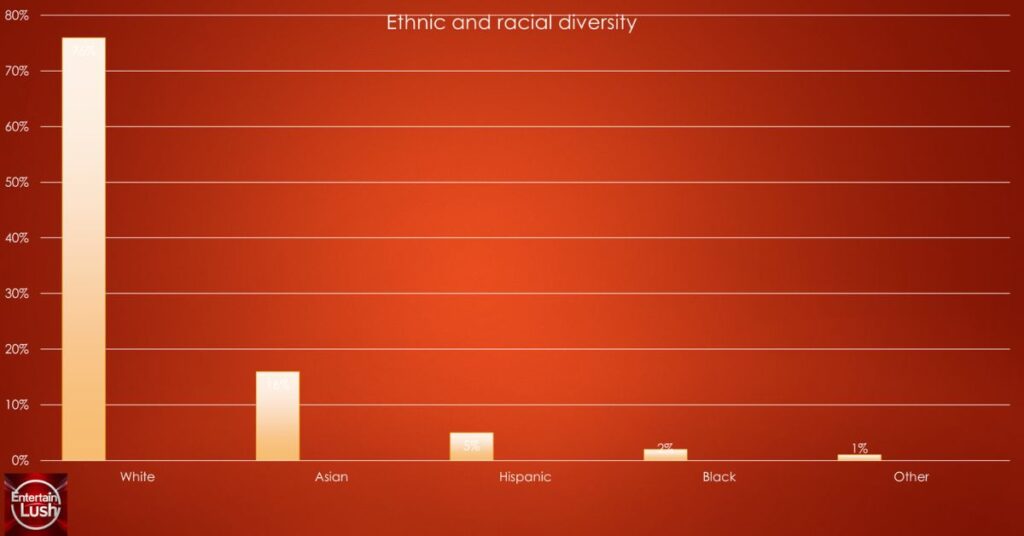

Ethnic and racial diversity:

- White: 76%

- Asian: 16%

- Hispanic: 5%

- Black: 2%

- Other: 1%

In the United States of America, these figures need to indicate more economic opportunity. The statistics only signal the unbalanced wealth distribution among the super-rich individuals in the USA.

Sources of Wealth for US Ultra High Net Worth Individuals

Let us now delve into the means used by America’s super-rich to build their wealth:

Industry sectors producing the most UHNWIs:

- Technology

- Finance

- Healthcare

- Real Estate

- Energy

Lately, the technological revolution has produced many Ultra-High-Net-Worth Individuals. Fintech has mainly been a powerhouse in terms of wealth generation.

Self-made vs. inherited wealth:

- Self-made: 67%

- Inherited: 33%

Most US Ultra-High-Net-Worth Individuals built their wealth from scratch. This statistic often fuels debates about economic mobility and the “American Dream.”

Role of entrepreneurship:

Entrepreneurship plays a crucial role in creating UHNWIs. Many ultra-wealthy individuals founded successful companies, and early in the game, some invested in startups that became giants.

Also Read: The Incredible Net Worth of Mr. Beast (2024)

Impact of Ultra-High Net-Worth Individuals on the US Economy

UHNWIs wield significant economic influence. Their impact extends far beyond their spending habits.

Contribution to GDP and tax revenue

Ultra-high-net-worth individuals contribute significantly to the US GDP and generate significant tax revenue, though tax policies often favor the wealthy.

Philanthropic activities and social impact

UHNWIs make ample disbursements as they contribute towards improving education, better healthcare delivery systems, and various community-based projects. On the other hand, there are so many arguments by those who criticize philanthropy as not dealing with structural imbalance.

Influence on policy and economic decisions

UHNWIs often have an outsized influence on policy-making. Their economic power can impact legislation such as tax laws and financial regulations.

Challenges in Tracking Ultra High Net Worth Individuals

Counting and closely following up individuals with ultrahigh net worth is difficult. There are many factors which make this exercise hard to do:

Privacy concerns and data limitations

Many ultra-wealthy individuals value their privacy. They may use complex legal structures to shield their assets from public view.

Offshore wealth and tax havens

Some UHNWIs keep significant portions of their wealth overseas. It can make it difficult to assess their actual net worth.

Fluctuations in asset values

The net worth of UHNWIs can change rapidly due to market ups and downs, and changes in property value sometimes greatly affect their financial status.

Future Projections for Ultra-High Net-Worth Individuals in the US

In future America, what will the future hold for the super-rich?

Expected growth or decline

Analysts anticipate a growth in the number of super-duper-wealthy people in America. By 2025, this group could swell to over 150,000 individuals.

Potential impact of economic policies and global events

Changes in tax laws, trade policies, or global economic shifts could affect UHNWI numbers. Climate change and technological disruptions may also play a role.

Emerging trends shaping wealth distribution

- Rise of digital assets and cryptocurrencies

- Increasing focus on sustainable and impact investing

- Growing wealth transfer to younger generations

- The young generation is increasingly gaining wealth.

Frequently Asked Questions

How much do UHNWIs differ from billionaires?

UHNWIs possess wealth above $30 million, but billionaires are worth at least $1 billion. Unlike UHNWIs, there are few billionaires.

How do US UHNWIs compare to those in other developed nations?

There are more UHNWIs in the US than anywhere else. About 30% live there out of all those categorized as ultra-wealthy on earth.

Approximately what fraction of the population of the United States is constituted by ultra-high-worth individuals?

The UHNWI in the United States accounts for less than 0.1% and is relatively insignificant.

Conclusion

The number of ultra-wealthy people in the US is increasing, and as a result, there are considerable consequences for our economy and society. This raises important questions about wealth concentration and economic opportunity.

Understanding UHNWI demographics helps us grasp broader economic trends. It informs discussions on inequality, tax policy, and social mobility.

As wealth continues to concentrate, these conversations become increasingly crucial. Stay informed about wealth trends in the US. They shape our economic landscape and impact policy decisions.

Welcome to Entertainlush.com! Dive into a world of business insights, travel adventures, entertainment buzz, celebrity gossip, and sports highlights. Our expert writers bring you fresh, exciting content daily. Stay informed and entertained with Entertainlush.com!