It is challenging work for businesses and financial professionals to identify high net worth individuals (HNWI). This is especially challenging when there is often little data available.

The frustration increases when you realize that conventional measures like income and assets are overly simple. It not only discourages direct communication but also hinders the creation of close and lasting relationships.

When financial behaviors, choices and relations are analyzed, it is easy for commercial entities to target the actual and potential HNWIs correctly. This method increases your opportunities to establish strong relationships and deliver tailored services.

Definition of High-Net-Worth Individuals

High net worth individuals (HNWIs) are those individuals that possess large amounts of wealth in terms of financial capital. Generally, this implies having liquidated assets of one million dollars and above.

These assets are cash, fixed deposits, shares, bonds, and all types of securities which give returns. The exact level may be different, depending on the country and the credit organization. High Net Worth Individuals always invest in complicated structures.

Financial Indicators of HNWIs

The general definition of HNWIs is based on financial criteria that define the status of HNWIs. These are high levels of income, large amounts of assets and diverse investment activities. High Net worth Individuals are usually characterized by multiple sources of income and good liquidities.

They possess properties and other assets considered a higher standard or luxurious. These help in identifying those with substantial worth by monitoring these indicators.

Income Levels

High net worth individuals (HNWIs) have high sources of income. This income may be in the form of wages or salaries earned, profits generated from businesses and other forms of investment. Most companies set the eligibility criteria based on an annual income of $200,000 or more. The constant high level of income shows earning capacity and reliability of incomes earned.

Asset Holdings

HNWIs have many types of assets. These include purchase of stocks and bonds, owning of real estate and purchase of non-consumable products such as art and collectibles. It is common that they invest in different stocks in other companies to reduce risk and obtain the highest possible gains. The value of these assets is not to be overlooked as it gives them a strong net worth.

Investment Portfolios

HNWI generally has a diversified and sizable investment portfolio. They invest in stocks, bonds, monetary funds, fixed funds, properties, and private equity. These portfolios are well balanced with a view of achieving their financial goals of growth and stability.

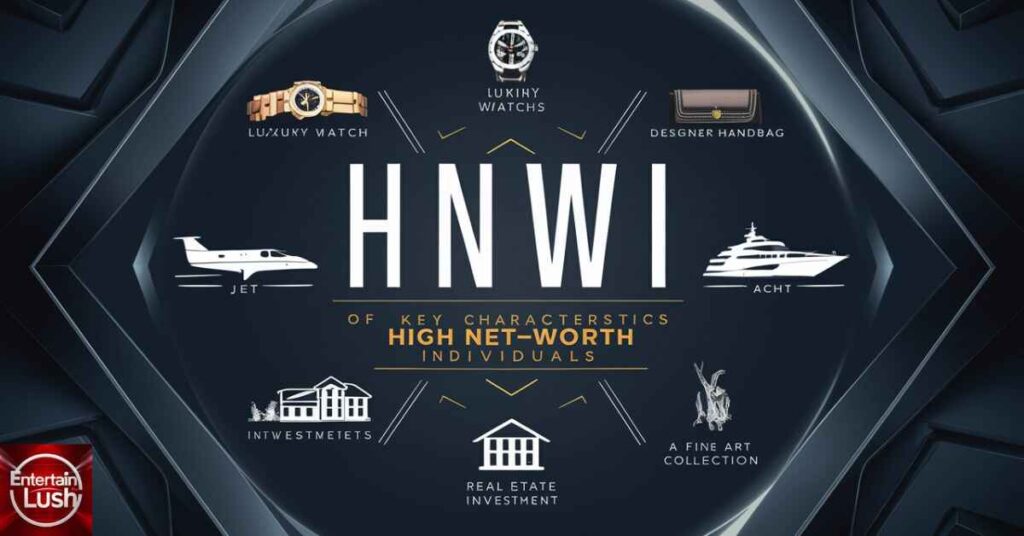

Lifestyle Indicators of HNWIs

Lifestyle choices and behaviors of HNWIs are not inevitable but are unique. These include buying expensive items and being members of an elite circle and frequent traveling. These people prefer to reside in posh areas and ensure their children get quality education. These lifestyle indicators make it easier in identifying HNWIs and also in understanding their characteristics or requirements.

Luxury Purchases

HNWIs make purchases of luxury products and services. They purchase luxurious cars,sea going boats and small aircrafts. They also purchase paintings, other valuable assets, jewellery and branded outfits. These purchases are status symbols, due to their affluence. Monitoring these buying patterns give us clues relative to their financial solvency and individual preferences.

Exclusive Memberships

High net worth individuals are known to frequently avail memberships in private clubs and associations. Some examples are private country clubs and yacht clubs as well as social societies. These groups afford the chance to get connected to the elites and offer possibilities to attend the high-profile functions. It also establishes a level of income and social class as well.

Travel Patterns

HNWIs typically have distinctive travel patterns. They prefer luxury destinations, five-star accommodations and first-class or private flights. They may own vacation homes in desirable locations. Understanding their travel preferences helps businesses tailor services to meet their needs and enhance their experiences.

Professional and Social Networks

High net worth individuals (HNWIs) often belong to influential professional and social networks. These networks provide opportunities for collaboration and connection. HNWIs typically engage in various associations that enhance their business interests and social standing. Understanding these networks helps identify potential clients and partners in the high net worth segment.

Business Associations

HNWIs commonly join business associations and boards. These memberships allow them to connect with other successful individuals and access valuable resources. Participation in influential groups helps HNWIs expand their networks and enhance their business opportunities. This involvement is a key indicator of their status and influence.

Social Events and Philanthropy

HNWIs engage in numerous social occasions and charitable organizations. They commonly go to black tie events, fundraising dinners and other high-profile events. Some are engaged in philanthropy, they give to organisations that they think deserve their support. This engagement does not only highlight the fact that they are rich but also the desire to contribute positively to society.

Technological Indicators

HNWI are characterized by integrating complex technologies and other digital platforms. These resources they effectively utilize to address the issues of wealth and to an extent ease their lifestyles.

As investors, they apply technology in tracking of spends, budgeting and planning for their future, and personal finance software. Knowledge of these technological factors aids in defining HNWIs and their approach to wealth management.

Tech Gadgets

The luxury brand consumer often uses fancy technological devices and smart home products. This encompasses new models of smart phones, smart home appliances and entertainment products. This is evident based on their ability and willingness to invest in the latest Technologies with an aim of enhancing comfort. These gadgets also indicate that they are able to purchase extra items that make up their lifestyle.

Financial Technology Usage

These investors are always on the lookout for new and innovative financial technologies and digital banking. These people utilize shifting applications on their smartphones for investment targeting, stock and cryptocurrency trading, and virtual banking. This use of fintech enables them to organize their wealth and be knowledgeable about the market status.

Geographic Concentrations

There are certain areas that are more popular with billionaires than others; the same can be said with countries and cities. Most of these regions are developed with posh homes, posh service provision and nice recreational products.

Such concentrations are important in business since they enable marketing and services to be directed to the right places. This is an important factor to consider for future marketing and promotional strategies around HNWIs. Their living areas reveal much about their lifestyle and spending habits.

Global Hotspots

There are some cities and countries that are globally identified as having high concentrations of HNWIs. HNWI are attracted to places such as New York, London, and Hong Kong because of the available business and lifestyle prospects.

These places always have healthy financial structures and always produce creative content. Recognizing these areas helps businesses to focus their efforts on attracting affluent clients.

Emerging Markets

It refers to the territories that are witnessing an increasing scale of growth of high-net-worth individuals (HNWI’s). Such nations as China, India, and Brazil are witnessing more numbers of people attaining excellent worth.

These markets are new opportunities especially for companies that seek to cater for the rich customers. Market changes are critical in targeting and delivering appropriate services and products to the developing markets.

Professional Services Utilized by HNWIs

HNWI requires the services of several professionals to assist in the management of their wealth. These services include investment advice, legal aid and private banking services. Expert advisors are useful in ensuring that the HNWIs manage their wealth by investing in the right projects.

The second approach involves analyzing the professional services which can assist in understanding clients from the HNWI segment.

Financial Advisors

HNWI seeks to rely on financial advisors in order to manage them effectively and efficiently. They specialize in making recommendations regarding investment, retirement and wealth as well as other services. The high-net-worth investment is usually developed with the help of an advisor who comes up with a suitable plan depending on the financial objectives of the client.

Legal and Tax Consultants

Legal and tax consultants are often sought by the HNWIs to protect and enhance their wealth. Such specialists assist with numerous regulations and finding strategies to reduce taxes. Through engaging legal and tax consultants, HNWIs protect themselves and their wealth. It is paramount for sustaining well-being and future readiness as well.

Private Banking

Private banking services are a necessity to HNWIs, because they are connected with people who require such services for their daily needs. These services involve the provision of personal economic services such as stock broking and loans.

Private banks focus on the needs of the wealthy individuals, offering unique insights and specialized services. This level of service assists the HNWIs to handle their wealth in a better way.

Behavioral Characteristics

High net worth individuals’ (HNWI) typical behavior constitutes certain attitudes that affect their choices. They take time to think through their activities and such are likely to be strategic planners.

The high-net-worth individuals normally work with long-term goals and may not go for the short-term. By analysing those behavioral patterns, companies are able to offer better solutions that cater for the needs of the HNWIs.

Risk Tolerance

High net worth individuals (HNWIs) have different kinds of risk tolerance levels. Some investors may be risk averse and buy the bonds while others are equally willing to take the risk of investing in the stocks. This tolerance affects their investment choices and overall financial strategy.

Decision-Making Process

People who have high net worth use a rational model of decision making. They take into account factors such as financial objectives, market conditions and advice from other professionals.

This cautious approach helps to avoid mistakes in their financial and life decisions and achieve their goals. By understanding this process, service providers could be in a position to offer the right assistance.

Monitoring and Data Collection Methods

There are different ways of closely tracking and gathering information about high-net-worth individuals which includes online tools and face to face contact. These techniques are based on monitoring of the financial flow, foreign currency expenditures. Proper data collection methods allow businesses to effectively analyze the behaviors and preferences

of HNWIs.

Financial Databases

Financial databases are crucial in identifying rich people popularly known as high-net-worth individuals (HNWIs). These databases contain information about assets and investment portfolios, accounts and transactions.

This data helps businesses in defining who is a potential client and what type of services to offer. The use of financial databases improves the decision-making process and client-interaction information management.

Frequently Asked Questions

What defines a high net worth individual?

The high-net-worth individuals are in a position of having long term planning in mind and often they are not in the look out for short term kind of gains.

How can businesses benefit from identifying HNWIs?

Business entities should identify high-net-worth individuals to tailor their advertisements to

them. It also leads to improved client relations and thereby, the subsequent improvement in profitability.

What are the key lifestyle indicators of HNWIs?

High-net-worth individuals often buy luxury products, join exclusive clubs, and travel to luxury destinations for business and leisure. Their wealth influences these choices, defining their preferences and connections.

Which cities have the highest concentrations of HNWIs?

Major cities such as New York, London, and Hong Kong currently have a large population of HNWIs. These are places that gain wealth due to healthy economic activities and luxurious living.

How do HNWIs typically invest their wealth?

HNWIs work on a portfolio that holds stocks, real estates and others like private equity and hedge funds. It also allows them to handle risks together with possible profits or losses and in the right manner.

Conclusion

Identifying high net worth individuals (HNWIs) requires a comprehensive understanding of their financial behaviors, lifestyle choices, and social networks. By recognizing key indicators such as income levels, asset holdings, and professional services utilized, businesses can better tailor their offerings.

Additionally, monitoring trends and leveraging networking opportunities can enhance connections with this affluent group. Ultimately, focusing on HNWIs not only opens doors to lucrative opportunities but also fosters meaningful relationships that contribute to long-term success in a competitive market.

Welcome to Entertainlush.com! Dive into a world of business insights, travel adventures, entertainment buzz, celebrity gossip, and sports highlights. Our expert writers bring you fresh, exciting content daily. Stay informed and entertained with Entertainlush.com!